If you refer to the Act or use the high-level process that we describe, one key step after a board has passed a resolution to enter business rescue, is the appointment of a BRP who must accept in writing the appointment, which has implicit in it, an assessment of the reasonable prospects of rescue planning being accepted, and rescue succeeding. There has been a fair amount of controversy about more than just a few instances, where the view on reasonable prospect has been rescinded and insolvency processes have then been followed, against the spirit of the act. Soon, sanction will be taken, and to help avoid this, here is Spark!'s approach to assessing reasonable prospects. We hope it helps boards and business make good decisions.

As always, where you see a diagram, clicking on it will open up a higher resolution version with more detail in it.

Judge Eloff dismissed the application for business rescue (Southern Palace Investments 265 (Pty) Ltd v Midnight Storm Investments 386 Ltd.) He held that “...it is difficult to conceive of a rescue plan that will have a reasonable prospect of success of the company concerned continuing on a solvent basis unless it addresses the cause of the demise or failure of the company’s business, and offers a remedy therefore that has a reasonable prospect of being sustainable. A business plan which is unlikely to achieve anything more than to prolong the agony... by substituting one debtor for another without there being light at the end of a not too lengthy tunnel, is unlikely to suffice”. The court went on to state that the applicant must deal with “concrete and objectively ascertainable details in support of business rescue and which facts are beyond mere speculation”. These facts should include:

The court went on to state that without such details, a court is not only unable to consider the prospects of the company continuing in existence on a solvent basis but is also unable to consider the alternative aim of securing a better return for the creditors of the company than would arise from a liquidation.

So with these standards set, would it not be reasonable to engage before the board passes the resolution, so that an informed opinion can be offered and substantiated?

Can a BRP who has engaged with the company, creditors or shareholders prior to the commencement of business rescue be appointed as a practitioner?

Section 138 of the Act sets out the requirements for qualification as a business rescue practitioner. In particular Section 138(1)(e) provides that “A person may be appointed as the business rescue practitioner of a company only if the person...(e) does not have any other relationship with the company such as would lead a reasonable and informed third party to conclude that the integrity, impartiality or objectivity of that person is compromised by that relationship”.

A business rescue practitioner will not, merely by virtue of his prior engagement with creditors or shareholders, be held to lack independence. Something more, some “other relationship” will need to exist.

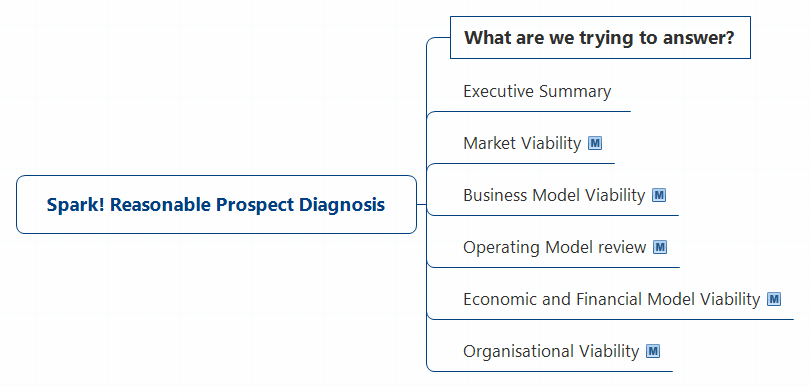

We need to present the inputs into how we form an opinion on the 4 key reasonable prospect considerations.

Spark!'s analysis and written view on the reasonable prospects of a rescue will require the following section inputs.

To set context and to summarize our view

You need to be able to have a convincing view of the reason for the existence of a business, Here are some considerations to explore on Market Viability unfortunately some businesses are in declining markets and must be allowed to fail, unpleasant as this is. either way you must have an independent view which allows you to explore other players in the market and alternatives distressed debt investor opportunities..

This is key to answering questions of scale, and exploring restructuring opportunities. Here are some considerations to explore on Business Model Viability Some business models, despite the product they serve to the market are just not viable, and need review.

This is key to providing insights into possible rescue tactics which may not appear obvious, Here are some considerations to explore on Operating Model review these include rehabilitation efforts, removal of waste, restructuring, value chain analysis, outsourcing consolidation, asset disposal etc

Obliviously key to providing a view on whether creditors can expect a significant benefit if a rescue is supported. Here are some considerations to explore on Economic and Financial Model Viability

The ability to successfully deliver on a rescue plan, without any calls for additional funding, Here are some considerations to explore on Organisation Viability and using the resources of the business itself is a key consideration. Of course, anything can get done with a limitless budget, but our guiding principle is to not have to seek additional funding for whatever reason.

Using these inputs we will be able to generate an informed opinion which meets the High Court standards as set out by Judge Eloff.